Big Wave of Hype 🌊🌷

Are AI & Web3 a Bridge to Hawaii?

You ever watch 100 Foot Wave on HBO, née HBO GO, née HBO Max, née Max? You should. The basic premise is the big wave legend Garrett McNamara becomes so obsessed with finding the perfect giant swell he moves to Portugal to try and do the unthinkable and surf Nazare.

Won’t give anything away, but by Season 2 Garrett’s obsession has attracted a myriad of surfers from all over the world. They flock to Nazare like a bat signal just went out, dropping whatever they are doing in Indonesia, Brazil, Hawaii, or whatever lat long they happen to be at.

Nazare just has a magnetic pull to a group of people that Liam Neeson would say possess “a very particular set of skills”. During Season 2 of the show Kai Lenny takes big wave surfing to a whole new level — this dude was casually pulling 360’s off absolute monsters. Even when he is getting battered to what for mere mortals would be an almost certain death he zens out and survives by “doing it for the content.”

⌐◨-◨

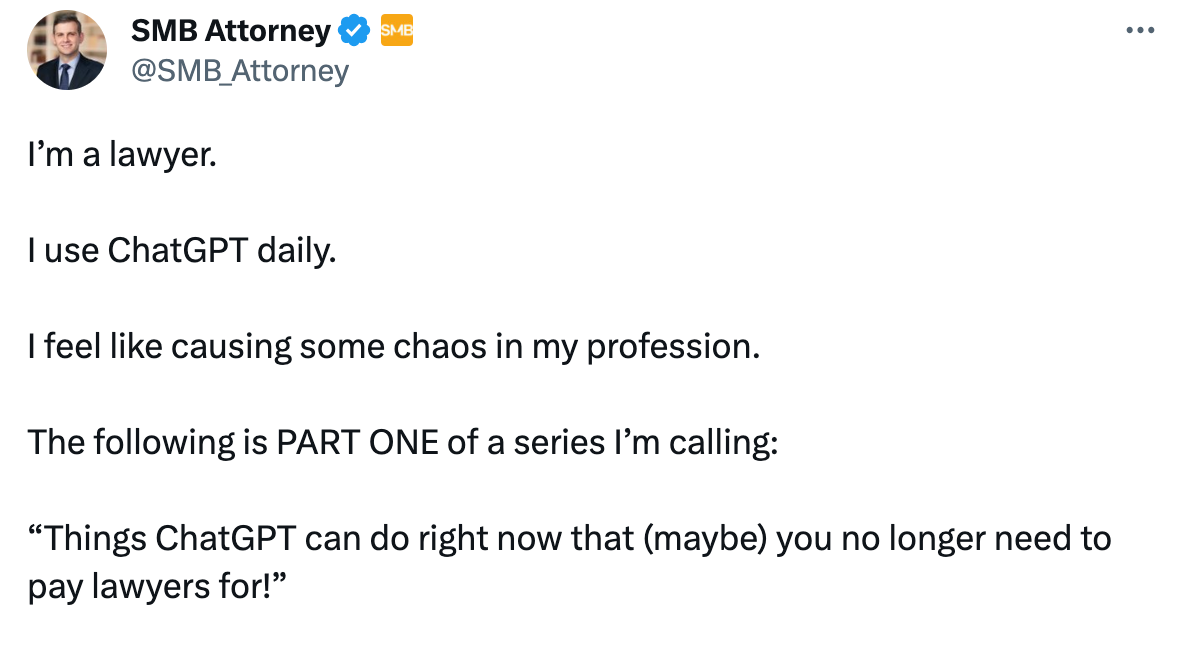

Point is, and here comes the sweeping segue, if you are or have been a digital entrepreneur at any level over the past 20 years or more, your big wave has always been AI. So much promise, never fulfilled, but oh so tantalizing. That is why at the start of this year, when 100 million people logged into ChatGPT in one month, they couldn’t get enough. Was Her finally coming? Was this moment where application layer players could finally build on all this long promised intelligence? Was this the infrastructure glue that was going to help connect digital property rights? Or was the entire thing just a dialog box wrapped up around a bunch of old Reddit posts? Was it still all hat and no cattle, or was this Valahalla?

How do you discern if *this* AI wave, or any tech trend for that matter, is Nazare in October of 2020, or that fictional bridge to Hawaii in BoJack season 4?

A certain group of players will tell you to keep your head down, keep doing what you are doing, keep grinding and don’t get distracted by the squirrel. And yes, you should stay laser focused on your company and stay in your lane — absolutely.

Focus is THE way to play the game at a certain stage. However, as an investor, an entrepreneur, or a company, if you miss the big waves, you could sink your whole ship.

Late to outfit your office with PCs in the 80s? Late to digital publishing in the 90s? Both might have spelled doom. Some business person somewhere once said you have to cannibalize yourself, no matter the size of your project. Bottom line is there is a difference between heads down focus and head in the sand willful ignorance.

Big waves, the real monsters, only come around once a decade. If your spidey-sense is telling you the big one is coming, you need to drop everything to learn as much as you can about it. Better to learn and be wrong than ignore and be right.

At its core, this 2023 AI movement feels a lot like the rise of HTML back in the 90s. Generative AI prompting is a language which plebes can use to summon the beast. OpenAI & the like are giving the non-technical a chance to dabble with some of this computing power and when a wave gets to the point where many humans can truly create on it, you usually end up with some Kai Lenny style rides.

AI feels like Nazare.

⌐◨-◨

🎲 The Web3 Casino

So far in 2023 the Web3 space has felt lost. We were promised property rights for the Internet and we got…this?

The inmates appear to have taken over the asylum, for the moment. It feels like it has become MORE complex and potentially MORE dangerous to move digital assets around via wallets here in 2023.

Crypto OGs with outwardly great OpSec have somehow been hacked, Ledger, the leader in self storage (not your keys, not your coins) movement, appeared to release (or almost release) software that allowed a way to peep your coins, rugs as performance art became the norm in NFT land, and even ye old stalwart Coinbase has been sued by the SEC. Not a fun time to “build”, which is desperately needed.

Despite all this, some of the most interesting Web 3 developments took place in the first half of 2023 as legacy brands, entrepreneurs and CEOs launched and are growing some very interesting projects, albeit distancing themselves from the now Dot Bomb sullied Web3 moniker.

Starbucks launched “stamps” which are digital collectibles driving a new loyalty program.

The co-founder of Eater & Resy launched a new restaurant loyalty app built on BASE.

If these new technologies are going to emerge, and we are betting they will, these are the type of projects that are going to move the needle.

Our current rough thesis is, eventually, AI & Web 3 will converge, in some respect, kind of like Mohamed Fouda talks about here. As usual, those who are focused on building now, while the crowds are away, will no doubt stand to reap the rewards as the infrastructure & UI gets better and more usable.

If AI can create deep fake Tom Cruise and blockchain can help debunk deep fake Tom Cruise, it sure seems like the intersection of these two technologies could help lead us to the future. First scammers & degens go parabolic, but then, great new applications that save us all time and money and provide us with ownership?

💰 Who ever heard of a SNOXXberry?

Where are you parking your cash? Haven’t heard that question much since 2008, but it was back in full force here in the 2-0-2-3.

In late March, a couple banks went under (SVB), many lost an incredible amount of market cap, and, for many, including us, it was time to stop just blindly trusting banks and get our TradFi OpSec in order — this is where a bit of Web 3 training was helpful.

Bottom line is that each and every person should take the time to put a cash management plan together that they personally feel good about.

Here is what we prioritized:

*Speed (can the funds move in 24-48 hours from our phone?)

*Liquidity (are there redemption gates? is there a market to sell instantly?)

*Securities (is the money market a registered security with the SEC?)

*FDIC limits

*Systemically Important Banks

At the end of the day, we decided that we felt safest parking a high percentage of available cash in money market accounts that were as “close to the bone” as possible. What is the bone? The US Government. In the history of the USA the government has never defaulted on its debt or failed to pay its obligations. Sure, there is always a first time for everything, but this felt like one of those situations where “if that happens, we all have bigger problems.”

That said, we started taking a look at money market funds like SNOXX, for example.

Each money market fund has a page where you can see the expense ratio, the liquidity, yield, and a breakdown of what is in the portfolio (this can change often).

This is not an endorsement of ANY money market funds, banks or brokerage houses. SNOXX is one of the funds we researched, and it happened to have a very funny name that reminded us of Charlie and the Chocolate Factory, so we used it to illustrate a point. Please do your own research and take your own risks.

⏲ Back in the 90s…

In the very late 90s, at some point, it became clear that as much promise as the Web and “DotCom” was ushering it, it was all going to crash. The world had simply gotten ahead of itself.

As the century turned, midnight approached on Web 1.0, however, there was a savior in sight, Prince Broadband. High speed internet was going to save us all and keep the party going, even though the only places that had broadband access were corporations and higher education institutions.

The rest of us were dabbling in DSL and many were still listening to this:

The Shannon limit of our phone lines appeared to be reached and we needed a bigger boat.

Broadband was so obviously the future, but by 2001, most people had tired of the promise of the Internet and were ready to move on, as the Web was deemed a “fad”, a home to snake oil salesman, charlatans, grifters, and worse by many.

Check out this story from Newsweek Magazine that ran in December 2001:

About 10 percent of U.S. homes get broadband, up from virtually none in 1998.

The larger problem is that once you've got it, broadband isn't much use. Downloading is quicker, but most of those fabulous multimedia services and new Internet appliances essentially don't exist.

It is impossible to convey how prevalent this attitude was in late 2001. Many, many people felt broadband Internet access was absolutely useless waste of time and money, especially after the Web 1.0 crash and subsequent bankruptcies of so many public and private companies built on what they felt was the empty promise of the Internet.

About 10 percent of U.S. homes had broadband by the end of 2001, up from virtually none in 1998.

That number today? A little of 20 years later? 90 % of US homes have broadband.

And that last 10%? Politicians are fighting over bills to bring rural broadband to the final 10%. While Elon Musk has a company for that, of course.

The author, went on writing for Newsweek & the Washington Post until the end of 2020, wonder if he ever became a Netflix subscriber.

🎵 Music To Set The Mood

🎵 Feel like I'm looking for my soul

Like a poor man looking for gold

There're thieves in the temple tonight…🎵